Is the 411 even still a thing or am I very much showing my geriatric millennial roots here?! Either way, we had a *lot* of questions about impact investing; What is it? How do you get started? Can it help the planet? What impact is it really making? Here’s what we found out.

I must admit that as an anti-capitalist, my personal utopia would be quite a departure from the financial status quo. But, I am also a realist and recognise that reaching that wonderland is a long way off in the future so operating within the existing framework and changing things from within is a much better plan than wishing them away. With that disclaimer out of the way, let’s get the lowdown on impact investing!

Don’t know a lot about investing?

That could be because you belong to a group that has been intentionally excluded from the world of finance. Women especially have received the message that the investing is ‘too complicated for them and that they just ‘aren’t good with money or numbers’. Despite women managing the household budget, the world of finance has historically been a male-dominated space. Speaker and financial educator (also TikTok star and podcast host) Tori Dunlap believes she was “put on this earth to advocate for women’s financial rights.” Dunlap has a theory that many of the myths and narratives around speaking about money are products of the patriarchy and that they put women and other marginalised groups are at a severe disadvantage when it comes to finance. She says that perpetuating the idea that money is something we shouldn’t talk about because it is ‘impolite’, ‘greedy’, or ‘tacky’ supports racist, misogynist, inequitable and unfair systems that exist because they keep marginalised groups out. Therefore, she continues, “the very act of getting your financial shit together is feminist.”

Some facts about inequality in investing that are bound to get you fired up: (based on US statistics. From Ellevest)

> 99% of investment management firms are owned by white men, 88% of senior fund managers are white, more than 70% of junior professional investors are white. Women make up only 8% of investors.

> Women hold 71% of their assets in cash (aka not investing to build wealth), vs 60% held by men.

> 60% of white US households hold stocks, which is double that of Black US households.

> 60% of white families also have at least one retirement account, while only 34% per cent of Black families do.

With all this in mind, diversifying the world of finance and investing is to a very sensible move (and long overdue!).

Investing 101(if you are already a super-savvy investor, feel free to skip this section!)

Why invest?

Isn’t investing just about greedy men getting richer and exploiting the rest of us?! Well, yes and no. Yes, it can be but no absolutely doesn’t have to be. It’s true that the world of investing, especially when we are talking about the stock market, has traditionally been dominated by wealthy white men who learn how to ‘play the game’ to increase their personal wealth. However it’s not just the uber-wealthy who invest, most people have some investment products without even realising it – a pension or retirement fund. The finance sector is slowly changing and impact investing is one area that is particularly positive area.

Before we dive right into that, it will be helpful to first understand some foundational principles. By definition, investing is something you do in order to get something back. Financial investments are a way to grow your wealth – you put your money into something with the goal of increasing its value. Most of us grew up learning that we should be saving our money, for a rainy day or for large purchases, but unless you came from a financially knowledgeable household you probably didn’t learn that leaving your money sitting in a savings account can actually be a bad thing in the long run. Why? Inflation. Inflation will almost always be higher than the interest rate you earn on your savings account.

Breaking down the basics

There are two main categories of investors – Professional Investors and Retail Investors.

> Professional Investors are individuals or institutions that have the experience, knowledge and expertise to make investment decisions and properly assess the risks that it incurs. There are many kinds of professional investors but two we will revisit are Venture Capitalists and Angel Investors. Venture Capitalists provide capital to firms that exhibit high growth potential in exchange for an equity stake. They tend to target companies who want to take their start-up business to the next level and scale up. Angel Investors provide seed funding for new start-ups and entrepreneurs. They are often high net worth individuals investing with their own money. Because so many new businesses fail, investing in them is very high risk.

> Retail Investors are individuals who invest through a manager and pay a small fee for that service. Roboadvisors are digital tools, apps and website, that act as managers for retail. They typically work by asking a series of questions about your financial profile – your budget, your goals, your appetite for risk and, more recently, the social issues you are interested in. This information is used to make decisions on your behalf to manage your money in a way that suits you best and will generate a good return.

There are two main types of investment – stocks and bonds.

> Stocks – a small piece of a company that anyone can buy on the stock market. By buying stocks, you essentially become a part-owner of the business. The value of the stocks fluctuate according to the value of the company and can be quite volatile. You can make a lot of money trading stocks but you can also lose a lot when their value decreases.

> Bonds – a type of loan. With bonds, you don’t have any ownership of the businesses so you don’t necessarily benefit from the company’s growth, but you won’t see as much impact when the company isn’t doing as well, either as long as it still can afford to pay its loans. You make money on the interest of the debt of a company or government.

I know this is a lot of terminology but bear with me – this will be helpful later on.

Mutual and Index Funds.

You have probably heard the terms Mutual Funds or Index Funds (or not, no judgement). Essentially, they are groups of stocks and bonds (and potentially a couple of other investment products but we are just going to focus on the most common ones for today). Funds serve as a way to diversify your investment and spread the risk. Funds mean that your money is spread across different products; different businesses and industries and different geographies. This diversification lowers the risk – if you invest in just one product or company, then your investment relies solely on the performance of that one thing. If you spread your money, some may be up while others are down and the overall risk is reduced.

Phew! That’s a lot of terms but now you are ready to delve into the wonderful world of impact investing.

Got it. So how is impact investing different?

The traditional realm of investing is driven by one main factor – generating the best return for the investor. Whether that is stocks, bonds or any number of other investment products, the motivation has been to grow wealth and for many, the ins and outs of the impact of particular investments was an afterthought at best. Most well-known funds are made up of companies that are performing well – think FTSE100 -so it is common to see multinationals like fossil fuel companies and huge plastic producers.

Now that our collective consciousness is waking up, we are seeing how everything we do is interlinked and that we simply cannot afford to ignore environmental and social impact in the pursuit of endless economic growth and wealth creation. The financial system is being shaken up across the board with the invention of cryptocurrency, the rise of neo-banks (also known as an online bank, internet-only bank, virtual bank or digital bank, a neo-bank is a type of direct bank that operates exclusively online without traditional physical branch networks) and a growing desire to build wealth in a way that aligns with our values and has a positive effect on the world around us. Cryptocurrency was motivated by a will to democratise finance and find an alternative to the banking system that was responsible for the financial crash in 2008. Many neo-banks have totally opted out of the fossil fuel industry from the get-go and are the first point of call for people who are working to divest their money from polluting industries.

We spoke to a leading expert in the sector – Melissa Kang, Founding Partner at JI Capital Partners, who says “Impact investing has become a fashion statement to indicate that one is socially responsible when one makes an investment. However, the purpose of making the investment can be different. In certain countries, allocating capital for impact investing can translate into tax benefits. For others, it has become their mission in life that all investments made must generate more net positive outcomes than just pure profits.”

Experienced impact investor, Helena Wasserman Eriksson, shared some definitions with us that also convey the evolution of impact investing from simply excluding ‘sin’ products in the early days to now seeking ways to address social and environmental issues and create positive change.

“Coined by the Rockefeller Foundation in 2007, impact investing describes investing strategies with the intention to deliver measurable impact. Impact investing is an umbrella word for the following investment strategies:

> Exclusion investments – this typically involves the exclusion of firms or sectors that produce so-called sin products like tobacco, alcohol, adult entertainment and weapons manufacturers.

> ESG – these strategies integrate environmental, social and governance (ESG) factors into the investment process. They are applied most explicitly in active management, where ESG issues are part of the fundamental analysis of a company.

> Thematic impact investing finance first – these strategies focus on investing in companies whose products and services are inherently impactful in a positive way for society and/or the environment.”

Wasserman Eriksson added that “The size of the market grew by an astonishing 42.4% in the last year — from $502 billion to $715 billion in assets under management. People are searching for a way to let their dollars make a difference in the world. A growing number of asset owners and managers have turned to impact investing, which is the deployment of capital to achieve both social and financial gains.”

A wide spectrum of options

The universe of investing is a complex one with much variety. The impact space is similarly varied, though still in its infancy and has a little catching up to do in terms of accessibility. Melissa Kang states “as many still view impact investing as something nascent. Private market investments are available only to accredited and institutional investors, they are not too accessible to retail investors. Retail investors can often only access mutual funds that invest in public companies.”

As we described above, funds are groups of stock and bonds that enable investors to spread their investment. So, how does the screening process work when deciding which companies to include in an impact fund? Kang explains that “the impact-oriented investors tend to have their own target impact goals, be it climate change mitigation or education or healthcare, just to name a few and will select opportunities from those sectors and apply the standard due diligence process to assess the opportunities. In many cases, investors may be willing to underwrite more risk in the sectors that they have targeted.”

So, each investor is an individual with their own set of values which means a one-size-fits-all approach would be ineffective. A difficulty arises when it comes to deciding what we count as a positive impact. There are no legal definitions for terms like ‘sustainable’, ‘ethical’, ‘climate-positive, ‘diverse’, ‘inclusive’ and they mean different things to different people. That is the first challenge. The second is, how does one assess what impact a company is having? Companies are motivated to promote anything positive they do for society and also eager to downplay their negative impact so investment managers need to be hyper-aware of greenwashing and vigilant about the selection criteria. As yet, there are no industry standards or benchmarks to work from so each investment manager has to create their own methodology and make judgement calls. Like many modern phenomena, the industry has moved quicker than regulation. Until the regulation catches up, businesses are screened on a case by case basis and every investment platform/manager will be doing so based on their own set of values.

Social Impact Bonds

In addition to putting your money in a managed fund, which is largely made up of private companies, you can also choose to invest purely in social impact bonds. These bonds provide financing to address social problems and look to fund preventative interventions. Although it does seem to be slowly changing, for a long time people believed that investing for impact meant forgoing maximum financial benefits. As Melissa Kang explains “many are still holding on to the notion that one must generate a low financial return if it is an impact-oriented investment. However, there are already many proven cases that investors can enjoy high profits while creating a very positive outcome. This is especially true if the product or service that was created is serving a large fast-growing market and the enterprise that produces this product or service is able to operate efficiently and generate an attractive profit.”

There is a wide variety of options on the market ranging from purely philanthropic to those with substantial returns that give traditional investments a real run for their money. Some impact bonds pay returns to their investors while others use the returns to invest back into the business to help it to continue growing.

Energise Africa bonds provide capital to families in sub-Saharan Africa to invest in solar energy that improves health, education and economic prosperity in rural villages.123,000+ tonnes of CO2 are mitigated annually by their investors, tackling one of the main causes of climate change and over £12million has already been paid out to stakeholders. Many of these bonds have an expected interest rate of up to 7%.

BlueOrchard Finance S.A. has invested in more than 200 million entrepreneurs across the globe. It provides both debt and equity financing to businesses and institutions, with an emphasis on alleviating hunger and poverty, fostering entrepreneurship, establishing food production and education programs, and working on climate change issues.

One of BlueOrchard’s focus areas as part of the Climate Change theme is climate insurance. In a recent impact report, they explained how “not only are the poorest countries more vulnerable to negative climate-related events; they are also less protected. Insurance can mitigate the effects of weather volatility by sharing and mitigating risk over time. Due to lack of insurance, economic setbacks caused by climate events tend to have a lasting effect, in turn reducing willingness to invest and hence limiting growth.” The report highlights the story of Mrs. Bibi, a dairy farmer in Pakistan. Worried about the cost of insurance, and unconvinced of the benefits, Mrs Bibi was hesitant to take out a policy to protect her livestock. Through the bond, she was provided with a loan to help with the costs of her insurance. Seven months later, a contagious animal disease driven by an extreme cold weather event killed her cow. She lost her animal which cost her three months income and was also burdened with medical costs. Ordinarily, an event like this might have plunged the farmer into more debt but because she has taken out insurance, she was able to make a successful claim which covered the cost of replacing her cow and ensured she was able to keep up with her outgoings.

JI Capital Partners invests in a broad range of entrepreneurial endeavours such as a business that has developed solutions using artificial intelligence and machine learning to improve the consumption of energy to a more optimal level, thereby reducing cost and CO2 emission. They have also financed a company that uses proven technology to process waste in Asia to become biomass feedstocks to support cleaner energy and prevent pollution from the environment.

Is this the future of investing?

Industry insiders predict that impact investing will become be the status quo. And the evidence to support that is stacking up. In 2020, the market reached roughly $715 billion in assets under management, according to GIIN. The International Finance Corporation (IFC) put the estimate even higher: $2.1 trillion.

Melissa Kang believes that “Allocation of capital for impact and sustainable investment will continue to grow from strength to strength until it becomes the de facto way of investing, it may take a decade or more but in general, there is no turning back.” She concludes that recent extreme weather events and fears around the climate crisis have “motivated many people to invest into new technology and solutions as well as investors to allocate capital to this space.”

There are several trends that support Kang’s forecast. Firstly, governments are digging deeper into their pockets. The Norwegian government recently approved US$1b of investment funds into emerging countries to combat climate change. In Singapore, the Monetary Authority announced $1.8 billion investments into five global funds centred on climate and sustainability.

There is also a shift towards better transparency and pushback against greenwashing. The European Union (EU) has implemented a European taxonomy for climate action related investment activities. “The Taxonomy is a list of economic activities with performance criteria to assess the activities’ contribution toward six environmental objectives — climate change mitigation; climate change adaptation; sustainable use and protection of water and marine resources; transition to a circular economy, water prevention and recycling; pollution prevention and control; and protection of healthy ecosystems. In other words, it describes what can be considered “green” and what can’t.”

Venture Capital

It certainly appears that professional investors are seeing the potential of the private sector to improve society and address the ecological challenges we face. Launched by French entrepreneur, Marie Ekeland, 2050 is a pioneer in the industry, focusing on only businesses that create a positive impact. They invest in companies aligning their core economic development with the best interests of people, society and the planet. Impact America Fund II (IAF) is a $55 million venture capital fund and the largest fund ever raised by a sole Black female general partner. So far,80% of the companies we’ve already invested in are led by a person of colour. 70% of them are Black-led.

Do I need to be rich to start impactful investing?

In short, no. While many opportunities are targeting professional investors, there is an increasing number of platforms, like Tickr and Clim8 in the UK or Ellevest and TulipShare in the US, that let you get started for as little as $1. And give you an example of what it would cost to have a slice in the vegan investment market, the share price of Oatly is currently at $15 and Beyond Meat at $117.70 (as of August 18th). Wasser Eriksson suggests that “if you have a little more capital to work with, you can try your hand at being an angel investor. The average minimum ticket size tends to be around $20K but you can get in with $2-10K sometimes if you meet the founders early.”

General financial advice for would-be investors is to pay down consumer debt and save a healthy emergency fund (3 – 6 months of living expenses) before you start investing. Of course, we are not licensed to give advice so if you are interested in getting started, please do seek out some professional guidance. Herfirst100k is a great place to start for financial education that will ensure you can proceed with confidence. When you are shopping around for impactful investments, you will need to be explicit about exactly what you do or do not want your money to be funding and will need to ask each prospective investment manager as many questions as it takes to satisfy whether they are a match for you.

From personal experience, when your money is already invested in funds (through an employer retirement account), finding out exactly what those funds are made up of is can be a real challenge. Easily accessible information on various products is customarily more focussed on financial information – the interest rate, the rate of return, tax implications. Finding out what your money is actually invested in invariably requires several calls and emails to reach the investment manager. Typically, you will only be given information about the Top 10 in the fund, and not a complete, itemised list.

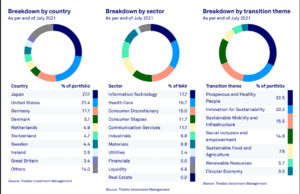

Listed as one of the top impact investment funds, according to Investopedia, Triodos Investment Management is a subsidiary of sustainable bank Triodos Bank and manages several sustainable investment funds. The bank’s areas of interest span renewable energy, sustainable food and agriculture (including organic farming), health care, and education. Taking the Triodos Pioneer Impact Fund as an example, let’s take a look at what good transparency looks like. On the Triodos website, you can download a pdf that gives a thorough breakdown of the fund including the Top 10 Holdings, the breakdown by sector, country and transition theme.

This example is multi-thematic rather than concentrating on one single issue makes it very clear what your money is invested in. If you are checking out a fund and this information is not readily available online, you should be able to get in touch and request it so you have a true picture.

As well as supporting black/queer/female-owned businesses and redistributing your wealth through mutual aid and donations, perhaps dipping your toe into the world of impact investing is the next step to leveraging capitalism against those who created it?